vermont sales tax calculator

If the tax paid on an out-of-state registered vehicle was equal to or more than the. The Vermont sales tax rate is currently 6.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

While gasoline purchases in Vermont are not subject to sales tax there is an excise tax on fuel in Vermont.

. The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Just enter the five-digit zip code. 2021 IN-152 Underpayment Adjustment Calculator. Vermont Documentation Fees.

The combined rate used in this calculator 7 is the result of the Vermont state. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates. Learn about the regulations for paying taxes and titling motor vehicles.

Therefore car buyers get a tax break on trade-in. Average DMV fees in Vermont on a new-car purchase add up to 70 1 which includes the title registration and plate fees shown above. The state sales tax rate in Vermont is 6.

Credit will be given for the purchase and use or sales tax paid on this vehicle to another jurisdiction. Tue 02162021 - 1200. This calculator is designed to give a simplified answer regarding the taxes you may owe based on the inputs you provided regarding capital gain s and losses.

Tue 03012022 - 1200. Groceries clothing prescription drugs and non-prescription drugs are exempt from the. The state sales tax rate is 6 while the combined state and local tax.

To know what the current sales tax rate applies in your state ie. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. The minimum combined 2022 sales tax rate for Vernon Vermont is 6.

Before-tax price sale tax rate and final or after-tax price. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. There are four tax brackets that vary based on income level and filing status.

State taxes are not considered in. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. Find your Vermont combined state and local.

The sales tax rate is 6. This is the total of state county and city sales tax rates. Vermont sales tax has numerous local taxing levels that must be monitored and maintained on a regular basis it is complex and time consuming due to the volume of jurisdictions.

Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. The Vernon sales tax rate is 0.

Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. The Vermont Tax Calculator is a useful tool to help you determine the amount of taxes you owe on the income you earn. Tax Year 2021 State of Vermont Annualized Income Installment Method.

Vermont has a 6. Vermont Use Tax is imposed on the buyer at the. The state tax on regular gasoline totals 1210 cents per gallon.

Vermont includes the sale price and the doc fee in the taxable amount of an auto loan but does not include the trade-in value nor the rebate. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. The sales tax rate for Middlebury was updated for the 2020 tax year this is the current sales tax rate we are using in the Middlebury Vermont Sales Tax Comparison Calculator for 202223.

The Vermont sales tax rate is currently 6. The states top tax rate is 875 but it only applies to. Vermonts tax rates are among the highest in the country.

The base state sales tax rate in Vermont is 6. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Vermont State Tax CalculatorWe also provide.

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

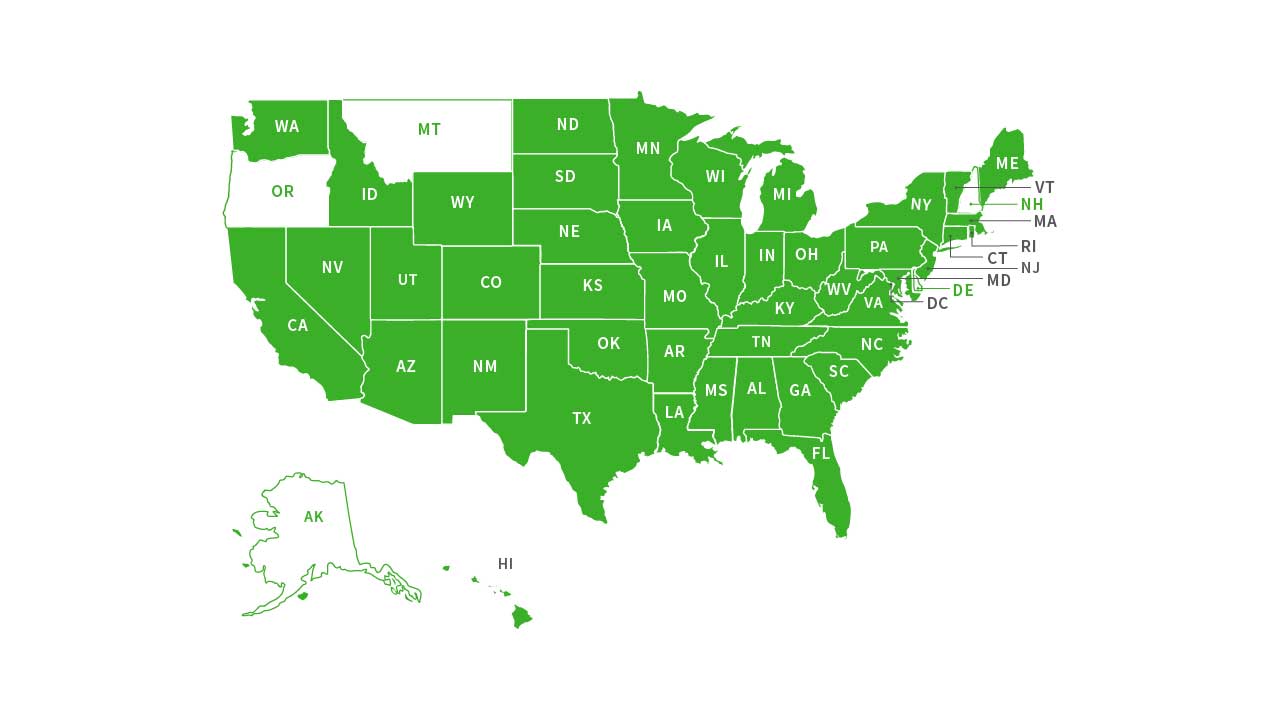

Transfer Tax Calculator 2022 For All 50 States

States With Highest And Lowest Sales Tax Rates

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

Vermont Sales Tax Small Business Guide Truic

Vermont Property Tax Rates Nancy Jenkins Real Estate

Sales Taxes In The United States Wikiwand

The Consumer S Guide To Sales Tax Taxjar Developers

Michigan Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Vermont Income Tax Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Sales Tax By State Is Saas Taxable Taxjar